Online payments

Pay online local taxes and duties by card or transfer with instant confirmation.

Secure and Fast Payments

Modern payment platform with real-time processing

Why pay online?

Speed, security and maximum comfort

24/7 payments from anywhere

Pay taxes and fees anytime, without counter hours or travel

Certified banking security

Transactions protected with 3D Secure and PCI-DSS certified SSL encryption

Instant electronic receipts

Receive payment proof immediately after transaction, with electronic signature

Automatic fiscal status update

Payment reflects instantly in fiscal dashboard, no delays

View and pay all fiscal obligations

Centralized dashboard displays all your local taxes: tax on buildings and land, vehicle tax (cars, motorcycles), sanitation and household waste tax, fees for authorizations and certificates, fines and penalties. See outstanding balances, upcoming deadlines, installment payment possibility and discounts for early payment.

Choose the payment method that suits you

Bank card (Visa, Mastercard) - instant processing. Online bank transfer (internet banking) - confirmation in 1-2 hours. Electronic wallet - cashless and fast. Standing order for automatic recurring payment (don't forget deadlines). All transactions are PCI-DSS and 3D Secure secured. Receive electronic fiscal receipt immediately after payment.

Secure and certified payments

Banking security and legislative compliance

High transaction volume

Tens of thousands of citizens pay online every month

PCI-DSS level 1 certification

Highest security standard for payment processing

Protected banking data

We do not store card data, processing through secure gateway

256-bit SSL encryption

All communications are end-to-end encrypted

Dedicated technical support

Support team for payment issues, available daily

Refund guarantee

Automatic refund in case of double payment or error

Online payment advantages

Pay simpler, faster, safer

Early Payment Discount

Pay by March 31 and get 10% reduction on property tax and vehicle tax (according to HCL).

No Additional Fees

No commissions for online payment. Pay exactly amounts displayed in fiscal statement, without hidden costs.

Instant Confirmation

Payment is confirmed in account in maximum few minutes. Receive fiscal receipt by email immediately after transaction finalization.

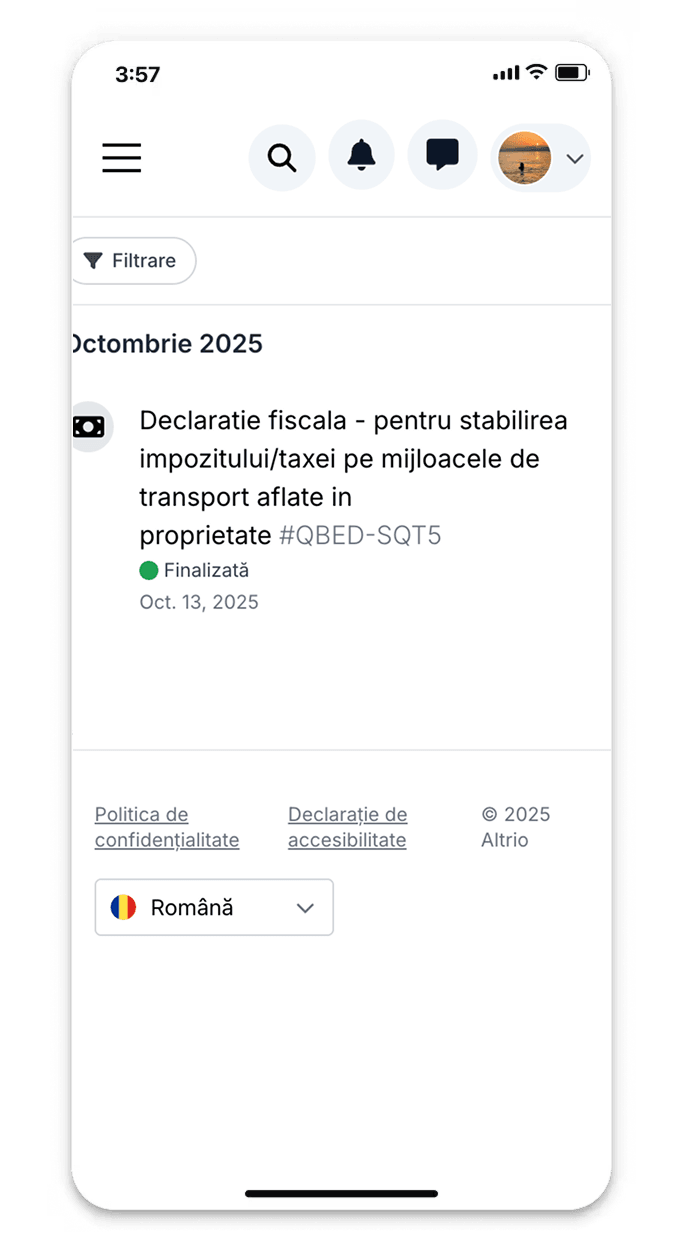

Access complete payment history and documents

See all payments made: date, amount, payment method, transaction reference. Download fiscal receipts for any previous payment. Generate annual reports for all taxes paid (useful for accounting, tax exemptions). Export data in PDF or Excel format for personal archiving.

How to pay taxes online

Simple guide for fast and safe payments

Authenticate in platform

Log in with your verified account. All goods registered in your name (properties, vehicles) will be automatically synchronized and you will see fiscal obligations for each.

View owed taxes

Access 'Online Payments' section where you will find complete list: current taxes (current year), arrears from previous years, future deadlines, possible discounts for early payment. Each position displays: payment amount, due deadline, possible late penalties.

Select what you want to pay

Check taxes you want to pay now. You can pay: all taxes at once, only certain positions (e.g. only house tax), in installments (where permitted). Payment total is automatically calculated and clearly displayed before checkout.

Choose payment method

Select preferred method: Bank card - fill in card details (3D Secure secured), Bank transfer - will be redirected to your bank, Electronic wallet - log into your wallet account. Check one last time total amount and payment breakdown.

Confirm and finalize payment

Press 'Pay' and follow payment processor steps. For card: enter details and security code received by SMS (3D Secure). Transaction is processed in seconds. You will see confirmation message: 'Payment successful' or 'Payment failed' (with reason).

Receive and save receipt

Download electronic fiscal receipt immediately after payment (available also by email). Receipt contains: fiscal number, payment date, amount, breakdown for each tax, verification code. Save receipt for your records. Paid taxes status updates automatically in account.

Pay all obligations from one place

Unified dashboard with all your payments to city hall

All types of taxes and fees available

Card payment or instant bank transfer

Electronic receipts with digital signature

Complete transaction history

Available payment types

All financial obligations to city hall in one place

Local taxes and fees

Buildings, land, vehicles, other local taxes

Public services

Waste collection, water, sewerage, public lighting

Certificates and authorizations

Fees for issuing administrative documents

Fines and penalties

Traffic fines, contraventions, penalties

Real-time revenue monitoring for administration

Finance department officials access complete monitoring dashboard: real-time collections by tax categories, evolution graphs collection vs. same year last year, top taxpayers by amount paid, geographic area heatmap with collection rates. System offers automatic reports: daily situation for economic director, monthly report for local council, revenue predictions based on historical trend. Mayor can track collection targets and identify areas with non-payment problems for targeted recovery actions. Cash elimination reduces security risks and cashier errors.

Advantages for citizens and administration

Platform that streamlines tax collection and payment

80% processing time reduction

Citizens pay instantly without queues, and city hall processes automatically without manual data entry

35% improved collection rates

Easy online payment access increases tax compliance and reduces late penalties

Paper elimination and digital archiving

Zero physical receipts, all documents digitally archived with instant search for both parties

Total financial transparency

Every payment traceable with timestamp and cryptographic proof, complete audit for authorities

Payment Security and Protection

3D secure protection

Mandatory authentication through your bank for each transaction

End-to-end encryption

Data transmitted encrypted SSL 256-bit to authorized processor

Fraud monitoring

Automatic fraud detection and prevention system

PCI-DSS compliance

We comply with all international payment security standards

Payment categories for all needs

From individual citizens to large companies

Citizens - individuals

Taxes on personal properties, vehicles, waste collection taxes, contravention fines, certificates and authorizations

Legal entities - companies

Taxes for commercial buildings, corporate vehicle fleet, advertising taxes, commercial authorizations

Public institutions

Inter-institutional payments, budget transfers, taxes for reciprocal administrative services

Delegated payments

Payments made by legal representatives, guardians, lawyers, authorized accountants for clients